Pandemic borrowing binge

The Duterte regime announced on August 6 its plan to borrow an additional ₱3 trillion next year. The regime will use the money to finance the country’s ballooning chronic budget deficit. As in previous years, there are insufficient funds to finance its programs and loan payments next year.

The amount set to be borrowed is equivalent to 67% of the planned ₱4.5-trillion national budget for 2021. This means that for every ten pesos that the reactionary government will spend, seven pesos will be funded using debt. The planned budget is 10% higher than the ₱4.1-trillion national budget this year.

Even the regime’s economic managers admitted that the budget deficit will further balloon in coming years especially as tax revenues are expected to plunge due to continuing lockdowns across the country. They estimated that the budget deficit will reach a record-high of ₱1.82 trillion for the entire 2020.

Based on the regime’s estimate, the budget deficit has already reached ₱560.4 billion during the first half of the year. The amount is more than 13 times higher compared to what was recorded during the same period in the past year. The ballooning deficit is primarily a result of tax losses due to widespread lockdowns which put a halt to production and other economic activities across the country. This in addition to huge tax losses due to incentives given by the regime to corporations during the pandemic (Read related article in Ang Bayan, June 7.)

With falling tax revenues, the regime trimmed down its initial targeted tax revenue this year by 28% to ₱2.29 trillion. As of July, the regime has been able to collect only 32% of the said amount.

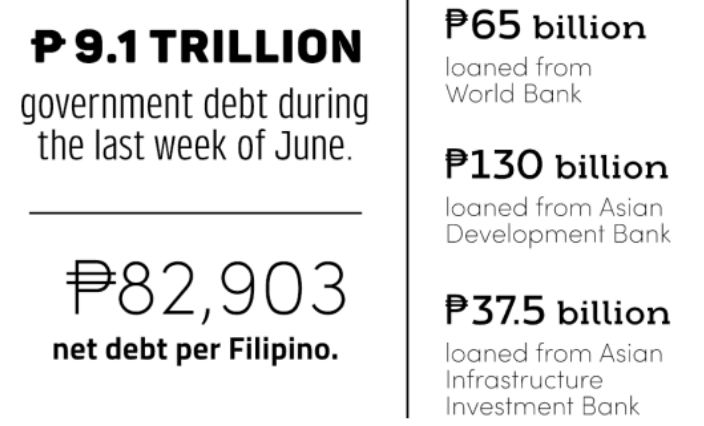

Amid the sore lack of funds, the regime went on a borrowing binge and incurred a debt of of ₱1.7 trillion during the first six months of 2020 alone. The amount is more than twice higher compared to debt incurred during the same period last year.

Where do debts come from?

According to the reactionary government, 75% of the targeted borrowing next year will be accumulated in the form of government bonds, while 25% will be sourced from imperialist banks and financial institutions.

In the past six months, the regime incurred an internal debt of approximately ₱1.3-trillion through sale of government bonds, and ad external debt of ₱226-billion.

To impress foreign banks, Finance Sec. Carlos Dominguez repeatedly boasted that the Philippines will never stop paying debt even amid the pandemic. During the first half of the year, the regime spent about ₱547.3 billion in debt payments while the people were hungry and jobless. Around 34% of the said amount was spent for interest payments.

To preserve its high credit rating and entice capitalists to buy government bonds, the reactionary government always strives to pay its debt and implement the neoliberal policy recommendations imposed by lenders. These ratings are given by imperialist credit rating agencies led by the so-called Big Three which includes the S&P Global Ratings (S&P), Moody’s and Fitch Group which are all based in the US and manned by World Bank technocrats.