Key information on the Philippine oil industry

The situation of the Philippine oil industry is indicative of the backward economic conditions in the country. Because of its low production and refining capacity, the local oil industry is tightly dependent on the importation of finished products. It will further become dependent because of fierce competition among large oil refining companies, especially those from China.

A huge part of the local oil industry consists of the importation of finished petroleum products (gasoline, diesel, kerosene and others), storage and distribution. The country also imports crude oil for local refining which supplies not less than half of petroleum products in the local market. Offshore mining of natural gas in seas in the western part of Palawan contributes minimally to the local supply, and reserves are expected to be depleted within a year or two.

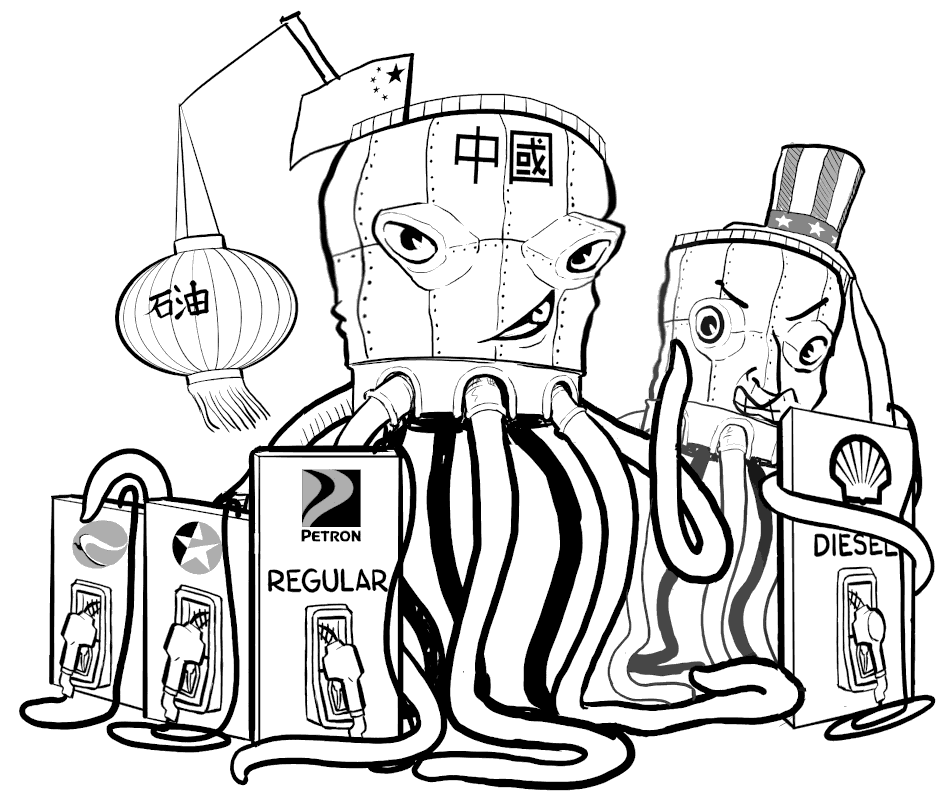

Two giants

The distribution of oil in the Philippines is dominated by two big companies: Petron Corp. which controls 24.88% of the local market, and Pilipinas Shell Petroleum Corp. which controls 18.25%, for a combined share 43.85% in total sales. Petron, formerly government-owned, is now owned by the San Miguel Corporation. Pilipinas Shell, on the other hand, is a subsidiary of the multinational company BP-Shell. Both Petron and Shell are always among the top five biggest companies in the Philippines. In 2019, Petron was the biggest company in the country in terms of sales.

Next to Petron and Pilipinas Shell is Phoenix Petroleum Philippines which controls 6.86% of the local market, Unioil with 6.48%, and Chevron Philippines (Caltex) with 6.13%. In sum, these five biggest companies control 62.6% of the total sales of petroleum products.

The remaining sales are shared by smaller companies, namely PTT Philippine Corp. (PTTPC), Total Phils., Seaoil Phil. Inc., TWAInc., Liquigaz, Prycegas, Micro Dragon, IslaGas, Jetti, Eastern Petroleum, Petrotrade, South Pacific, Marubeni, SL Harbour, Rockoil, RK3 Int’l., Insular, ERA 1, High Glory, Warbucks, Perdido, Golden Share and Filoil Logistics Corp. and others.

The sales and profit registered by oil companies during the first half of 2020 plumetted due to lockdown restrictions. However, these companies were able to recover their loses quickly during the second half of the year. Petron registered a profit of ₱1.6 billion during the third quarter, and ₱1.2 billion during the last quarter of 2020. Shell, on the other hand, registered a profit of ₱400 million during the last quarter, after suffering huge losses with the closure of its refinery in Batangas.

Oil importation

Majority of these companies are mere exporters of finished petroleum products and distributors in the local market. Until mid-2020, 60% of the supply of gasoline, diesel and other products in the country were directly imported. This has further increased with the closure of the Shell refinery in Tabangao, Batangas on September 2020. Since January 2021, 100% of petroleum products being sold in the Philippines is imported following the closure of Petron’s refinery in Limay, Bataan. The company declared its plan to reopen the refinery this July after being promised a tax incentive, but prospects for this remain dim as the company is expected to suffer loses amid tighter competition.

China is a bigger giant

China’s control and domination over crude refining and exportation of finished petroleum products is growing, especially in the Asia-Pacific region. During the third quarter of 2020, the share of China in Philippine diesel imports reached 64%. From January to November 2020, the volume of gasoline imported by the country increased by 434.1% to 1.7 million metric tons. The Philippines also imports from other countries including Japan, South Korea and Singapore.

China has the second biggest capacity for oil refining, and is expected to overtake the US within several years. It is the biggest importer of crude oil globally and, and has the biggest storage capacity. China currently dominates the sale of petroleum products in Asia. The biggest Chinese oil companies include PetroChina (China National Petroleum Corporation) and Sinopec. Australian and Singaporean refineries (Shell and Exxon) were forced to close down because of the high production capacity of China.