Multinationals rule Philippine pineapple production

Pineapple is among the top agricultural products in the Philippines. The country is the second biggest pineapple exporter in the world. Last year, the country produced 2.7 million metric tons (MT) of pineapples valued at ₱26.1 billion. Majority (85%) of local production is controlled by two multinational companies Del Monte Philippines Incorporated and Dole Philippines (Dolefil), both established by US companies in the 1920s. Del Monte Philippines is currently owned by the big bourgeois comprador Campos family, while Dolefil was bought by Japanese company Itochu Corporation.

Pineapples are sold fresh or canned as beverage or mixed in other food products. A small portion is also processed into fabric. Based on latest data by the regime, the average retail price of fresh pineapples is ₱53.07 per kilo. It claims that average farmgate price is ₱19.37 per kilo when, in fact, farmers are forced to sell their produce for as low as ₱5 per kilo.

Pineapple is planted across 66,048 hectares of agricultural land across the country. A huge part of this in concentrated in the Northern Mindanao Region (26,507 hectares) ad Soccsksargen (24,561 hectares). Dolefil’s pineapple plantations cover approximately 32,000 hectares of agricultural land, while Del Monte covers 20,000 hectares. These were originally ancestral lands grabbed from Lumads. Smaller pineapple farms are mostly controlled by these companies under leaseback and contract growing arrangements. Outside these companies, Lapanday Foods Corporation of the Lorenzo landlord family also contracts out smaller farmers to produce pineapples.

These companies aggressively expand their plantations to accumulate more profit from pineapple production. In 2014, Dolefil announced plans to expand its plantations by 12,000 hectares. This will cover agricultural and ancestral lands in Soccsksargen which have long been cultivated by settlers and Lumads.

These companies make use of contract growing and leaseback schemes for pineapple production to directly control lands owned by farmers. Under contract growing, the entire cost of production is shouldered by the farmer, while the price, quota and quality of products is solely determined by the corporation. The leaseback system, on the other hand, involves long-term leasing out of lands (owned by “cooperatives”) to corporations at extremely low rates. Farmers are prohibited from planting other crops, including those for consumption, in lands covered by these arrangements.

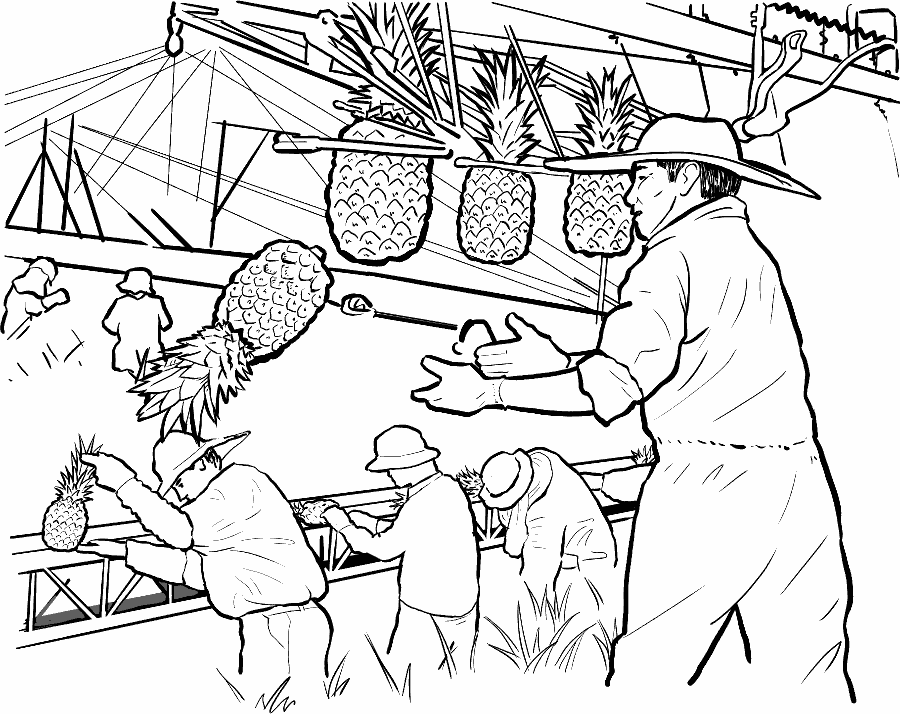

Exploitation of farmworkers

During harvest season, big plantations commonly employ sacadas to further minimize production costs. These workers are denied their rights to organize, unionize, and receive decent wages and benefits. The pakyawan (quota) scheme is also commonly implemented in plantations to accumulate more profit in the production of pineapples.

Farmers are further burdened and put under hazardous conditions due to systematic and long-term exposure to toxic chemicals (pesticides, herbicides and fertilizer) used by multinationals to accelerate the growth and extend the shelf-life of pineapples.

Export product

In 2020, the Philippines exported 990,780 MT of fresh and processed pineapples valued at ₱674.54 million. This comprises more than a third of total pineapple production in the country. The biggest volume of pineapples (71%) were exported by the country to the US (236,810 MT), China (231,340 MT) and Japan (231,080 MT). Under the Duterte regime, exports to China increased by five times from 44,360 MT in 2016 to 231,340 MT in 2020.

In the US, the average retail price of fresh pineapple is $1.44 (₱72) per kilo or four times higher than the farmgate price (₱19.37) in the Philippines. Meanwhile, pineapple juice costs $2.8 (₱140) per liter.