Philippines relisted in money laundering grey list

The Financial Action Task Force (FATF) once again placed the Philippines in its “grey list” last June 24. This means the FATF will put the country’s bank and financial transactions under closer scrutiny.

Money laundering is “cleaning” illegally obtained dirty money through transfers involving banks or investments in legitimate businesses. The FATF is an international watchdog created by the G7 to monitor money laundering. The Philippines was blacklisted in 2000 and grey-listed in 2012.

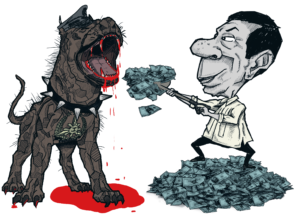

The FATF placed the country on the list despite amendments done by Rodrigo Duterte to the Anti-Money Laundering Act last February and the passage of the Anti-Terror Law in June 2020 supposedly to counter “terror financing.” This is because both laws did not target the main sources of dirty money in the country—drug trafficking and corruption.

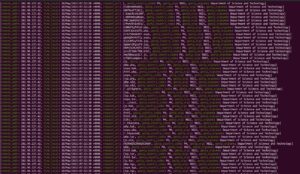

In 2019, the Anti-Money Laundering Council (AMLC) investigated 161,650 suspicious transaction reports (STR) from January 2013 to December 2017 worth ₱17.9 trillion. The agency discovered that 12,508 STRs worth ₱10 trillion involves drug trafficking and related crimes. Half (₱5 trillion) was reported during the Duterte regime’s first year of “war against drugs.” Between 2015 and 2016, the value of STR involving illegal drug trade rose by 200% . Despite dropping in 2017, suspicious transactions involving drugs remained higher compared to 2014. STRs are submitted to the AMLC for transactions suspected of involving dirty money.

Almost all transactions went through local banks. Some (29%) disappeared to the US, Costa Rica, Malaysia and Nigeria but bulk of the funds circulated inside the country.

In another more extensive study released by the AMLC in 2020, suspicious transactions rose by 11 times from 2013 to 2020. Between 2019 and 2020, it estimated that STRs increased by 68%, from 623,000 to 1.01 million.

Since 2012, international agencies monitoring international drug trafficking have put money laundering in the Philippines as a “serious concern.” In its 2021 International Narcotics Strategy Report released in March, the US said that Chinese syndicates have been using the Philippines as a regional transit country for illegal drugs and dirty money. These syndicates also supply the bulk of illegal drugs that are locally circulated and consumed. An AMLC report said 54% of the STRs submitted from January 1 to September 2020 are related to drug trafficking.

Other than the international operations of drug syndicates, corruption by government officials and human trafficking—both predicate crimes to money laundering—are also high in the Philippines. The inflow and outflow of dirty money is made easier when coupled with high volumes of remittances from migrant Filipinos. In addition to local banks, money is also laundered through private businesses, notably casinos. (One of the biggest casino owners in the Philippines is Duterte’s mega-crony Enrique Razon. His other crony, Dennis Uy, is set to build a giant casino in Cebu.)

In a separate report, the Securities Exchange Commission identified corruption as the main source of dirty money entering the country’s financial sector from 2017 to 2019. Most of the funds are from local politicians, though some were suspected to be from China. According to the SEC report, “terror financing” is “extremely low or nil.”