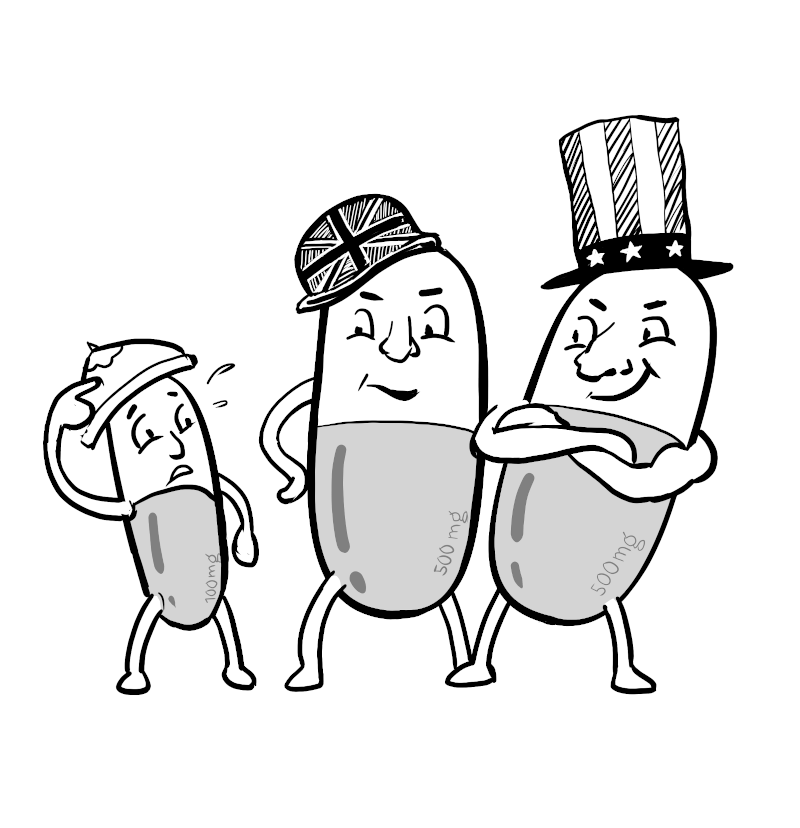

Foreign companies dominate local pharmacuetical industry

The Covid-19 pandemic exposed the Philippines’ lack of capacity to research and manufacture important drugs and vaccines. The Department of Science and Technology itself admitted that the country has no research facilities to develop a Covid-19 vaccine. Even before the pandemic, no local or foreign company manufactured a single vaccine inside the country. As of now, local companies have only signified their readiness to repack the vaccines into vials (fill and finish.)

Like other basic industrial sectors in the Philippines, foreign companies dominate the local pharmaceutical sector. A report in 2014 stated that 75% of the local drug and non-drug market is dominated by Pfizer (US), GlaxoSmithKline or GSK (UK), Boehringer (Germany), Sanofi (France), Abbott (US), Novartis (Switzerland), Johnson&Johnson (US), Roche (Switzerland), Merck (US) and Bayer (Germany).

With the exception of GSK, none of these companies manufacture locally. Others, such as Pfizer and Wyeth, have standing toll manufacturing contracts with Interphil Laboratories, a local subsidiary of Manchester Holdings (US) and part of the Zuellig Group of Companies (Switzerland). Interphil dominates the processing, labeling and packaging of drug and non-drug products of the 16 biggest foreign pharmaceutical companies for the local market and other countries in Asia. It processes its drugs in its factory in Canlubang, Laguna and locally supplies a third of the volume of foreign drugs in the market.

Only four companies can be called local or has local production. One of these is a local subsidiary of a US company and the other three are owned by local compradors.

According to data in 2014, about 65 local companies engage in toll manufacturing. Almost all of these use imported materials (up to 95%) from a few countries which produce basic components and chemicals. Most of these companies are medium-sized and owned by local companies. Some examples are AM-Europharma, AD Drugstel, Euro-med, Lloyd Laboratories, Hizon Laboratories, Swiss Pharma, Ace Pharmaceuticals and Allied.

Also in 2014, only two local pharma companies, Unilab and Pascual Laboratories, manufacture their own medicines. Unilab focuses on mixing and packaging generic drugs using imported materials. An example is paracetamol, an active pharmaceutical ingredient (API) of Bioflu, Tuseran and Skelan, which is imported from India and China. Pascual Laboratories, on the other hand, manufactures vitamins and herbal supplements gathered from their own farm in Nueva Ecija.

In any case, these companies are still largely engaged in manufacturing of branded drugs, such as antibiotics and steroids. Unilab has 6,000 workers working in five factories, two of which are focused on toll manufacturing. The company is owned by the local comprador family Campos. APIs used in manufacturing and processing of different kinds of drugs can only be imported from a limited number of countries. Some of the biggest suppliers are the big companies in US and Europe, as well as companies from India and China.

Other local pharmaceutical companies are limited to packaging, distribution and retail, such as Natrapharm, Medhaus Pharma, GX International, Prohealth Pharma and Cathay Drug.

Most of the drug and non-drug products (85%) of foreign pharmaceutical companies are distributed by Zuellig Pharma (related to Interphil Laboratories). Mercury Drugstore, owned by the Que family, dominate in retail, followed by smaller drugstores such as the Ayala’s The Generic Drugstore, the government’s Botika ng Bayan and hospitals.

In 2014, there were 500 registered traders, 700 importers and 5,000 distributors in the Philippines. Before the pandemic, sales were estimated to reach $4.1 billion (₱205 billion) in 2020, from $3.6 billion (₱180 billion) in 2016. This did not include estimates for Covid-19 vaccines that could reach up to ₱110 billion.