Predicament to be caused by Duterte's borrowing spree

Second part of the series on the Duterte regime’s borrowing binge. Read the first part, “Pandemic borrowing binge,” in Ang Bayan, August 21, 2020.

The regime’s economic officials on August 26 projected the government debt to reach a record-high ₱10.16 trillion by the end of 2020. This is higher by 31% than the debt recorded last year. The additional ₱160 billion which the regime is set to borrow this month will become part of this figure.

To justify the borrowing binge, the regime is repeatedly making it appear that the economy will be stimulated by the loans and funds that it will be able accumulate. As in the past, however, it is very clear that these onerous loans will only drive the nation to further bankruptcy to the detriment of the people.

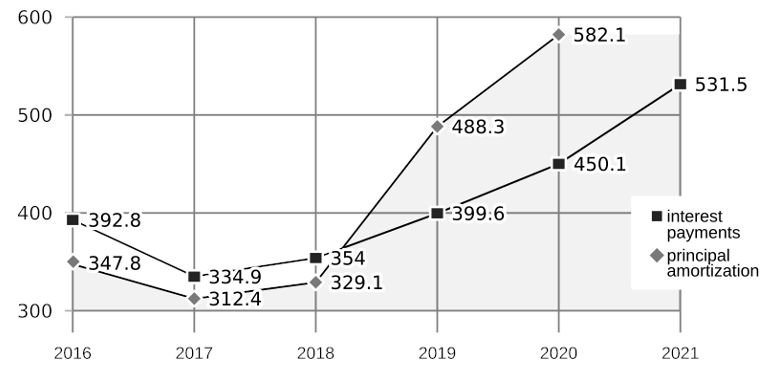

Next year, the Duterte regime plans to spend ₱531.5 billion in debt interest payments. The said amount is equivalent to 12% of the ₱4.51-trillion proposed national budget for 2021. This means that for every ten pesos that the reactionary government will spend, more than a peso will go to creditors. The average loan interest rate is also set to increase from 2.5-3.5% this year to 3-4.5% next year.

The proposed 2021 government fiscal program explicitly states that the planned appropriation for debt interest payments will correspond to borrowings to be availed of in the same year to finance the regime’s big-ticket infrastructure projects. This is utterly reprehensible especially that funds for aid, subsidies and other services which can directly help the people to survive the economic crisis caused by the pandemic and lockdown remain insufficient.

The proposed budget does not yet cover the payment for the principal amortization of current loans. This year, the regime appropriated ₱582.1 billion for this. From 2017, the Duterte regime has already appropriated ₱3.25 trillion to pay government debts, 47% of this is interest payments.

Automatic appropriations

The reactionary government is obligated to appropriate a huge chunk of the national budget for debt servicing. The Automatic Appropriations Law stipulates that debt servicing should be prioritized before allocating funds for the government’s essential operations, capital expenditures and programs. The Philippines is the only country in the world with this type of law. This was enacted by the earlier US-Aquino regime which promised to pay the funds loaned and plundered by the Marcos dictatorship “to the last cent.”

Under the Duterte regime, funds appropriated for debt servicing is equivalent to approximately 22% of the national budget annually.

Due to the chronic budget deficit, the reactionary state has always resorted to austerity by appropriating less funds for basic social services. With its overreliance on loans to provide a band-aid solution to the ballooning budget deficit, the regime is dying to comply with all the recommendations imposed by imperialist banks and financial institutions. Among the reforms currently being railroaded by the regime currently are taxes on basic food products such as dried fish and instant noodles, as well as on digital platforms (Netflix, Facebook, Twitter, and others). Small online entrepreneurs are now also obliged to pay taxes. (Read related article in Ang Bayan, July 21.)

These policy reforms are not new to Duterte. Even before the pandemic, he has rabidly complied with some of these neoliberal recommendations to achieve a high “credit rating.” The onerous programs implemented by Duterte in the past years include the implementation of the TRAIN and Rice Liberalization Law, K-12 educational reform, privatization of public properties such as the airport in Clark, low spending for health and educations, and many others.